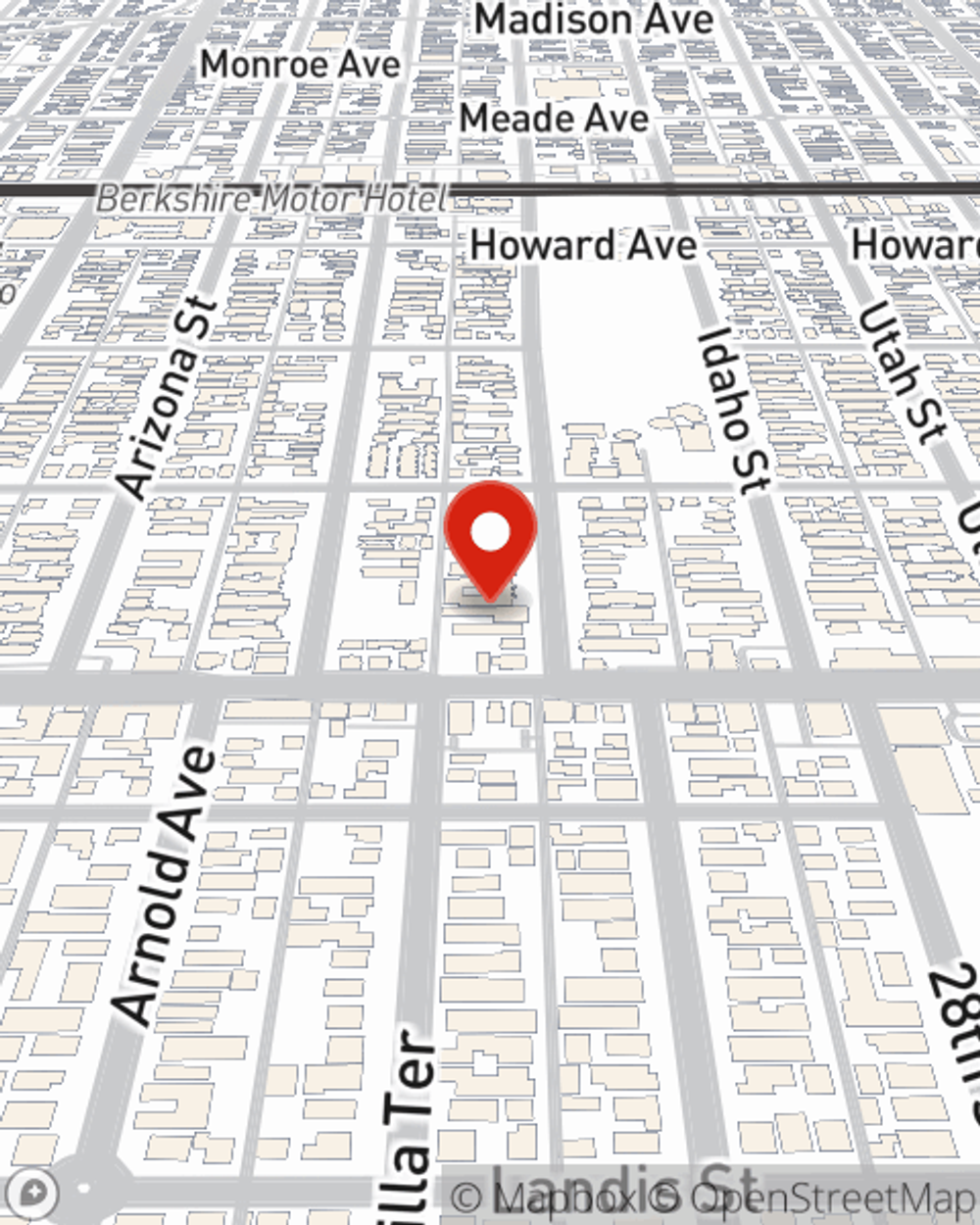

Life Insurance in and around San Diego

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- North and South Park

- San Diego County

- Kensington

- California

- City Heights

- Hillcrest & Talmadge

- Del Cerro

- Normal Heights

- Grantville

- Allied Gardens

- El Cerrito Heights

- Montezuma Mesa

- College-Rolando

- Temecula

- Maricopa County

- San Bernardino

- University Heights

- Mission Valley

- San Francisco

- Chula Vista

- Arizona

- Los Angeles

- Riverside County

- Palm Springs

It's Never Too Soon For Life Insurance

No one likes to entertain ideas about death. But taking the time now to arrange a life insurance policy with State Farm is a way to demonstrate love to your loved ones if death comes.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Love Well With Life Insurance

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Colethea Davis. Colethea Davis is the caring associate you need to consider all your life insurance needs. So if you're gone, the beneficiary you designate in your policy will help your loved ones or your family with certain expenses such as childcare costs, phone bills and grocery bills. And you can rest easy knowing that Colethea Davis can help you submit your claim so the death benefit is given quickly and properly.

When you and your family are insured by State Farm, you might rest easy knowing that even if something bad does happen, your loved ones may be covered. Call or go online today and see how State Farm agent Colethea Davis can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Colethea at (619) 795-3853 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Colethea Davis

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.